Playa Vista Real Estate Market Trends – April 2015

This month we are taking a look at the average price per square foot in Playa Vista versus the peak of 2005 and the bottom in 2011. We also have included statements form Realtor.com’s Chief Economist, Jonathan Smoke, regarding his thoughts on the possibility of a national real estate bubble.

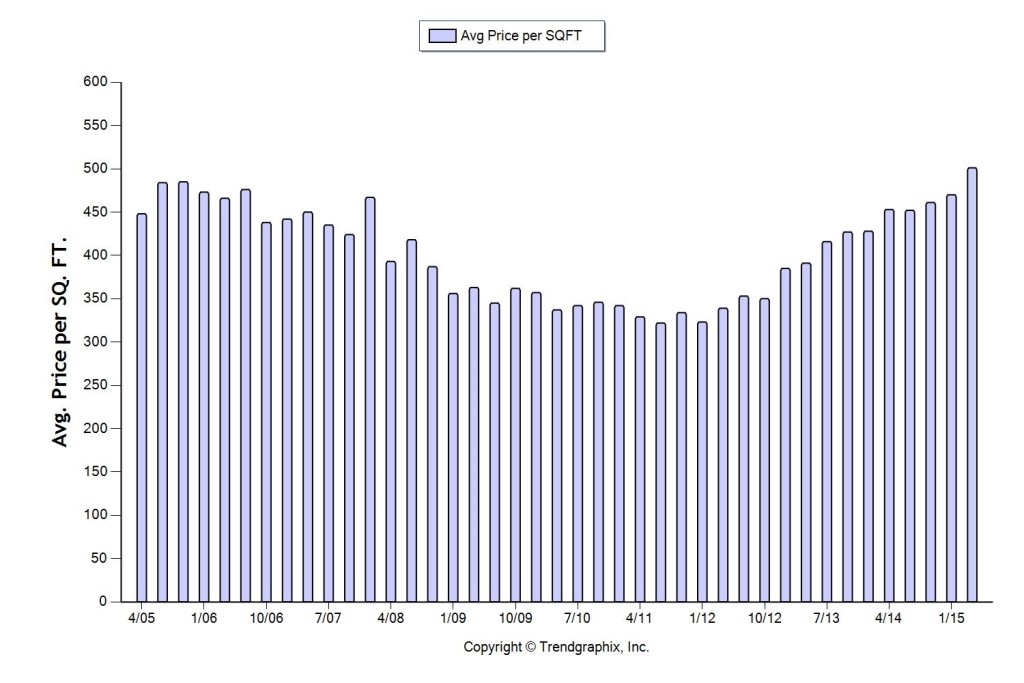

Historical Average Price Per Square Foot in Playa Vista – Back in the 4th quarter of 2005 the peak average price per square foot in Playa Vista hit $485. From this point prices started to level off and then the mortgage crisis took hold in 2006. The bottom was reached in 2011 at $329 per square foot. Since then we have been in recovery mode and now more recently a period of accelerated appreciation. Looking at the average for the last three months, Playa Vista’s current price per square foot is $501.

Strong demand for our neighborhood and very low levels of inventory continues to push prices up.

This chart shows the average quarterly price per square foot from 2005 through April 2015.

Comments from Realtor.com’s Chief Economist on the potential for a national housing bubble.

“During the peak years of the housing bubble, from 2003 to 2005, the data on supply versus price appreciation looked very similar to what we are seeing now,” writes Jonathan Smoke, realtor.com®’s chief economist, in recent commentary at the site. “But there are key differences, which is why I’m confident that on the national level, this is no bubble.”

Smoke says these home price increases will stick because the market is correcting for severe price declines in the recent past. Prices rose 7 percent and 12 percent in 2012 and 2013, respectively. Median prices have climbed less than 8 percent on a compounded annual basis over the past three years. On the other hand, from 2002 to 2005, median prices rose 10 percent on a compounded annual basis – and had no justification of a bounce from a prior decline, Smoke says.

Smoke also notes that during the housing bubble, mortgage financing saw rapid expansion, and flipping activity based on speculative investing soared—neither of which are occurring now.

“Today’s higher prices are only to be expected as the economy improves and first-time buyers gradually return to the market,” Smoke writes. “Eventually, those higher prices should encourage more owners to list their homes and builders to start construction on new housing—which in turn should solve the problem of supply.”

We recognize the Playa Vista market is different from the national market but many of the macro themes mentioned apply (low inventory, high demand, increasing prices, improving economy, recovery from the mortgage crisis).

Playa Vista Market Trends for April 2015

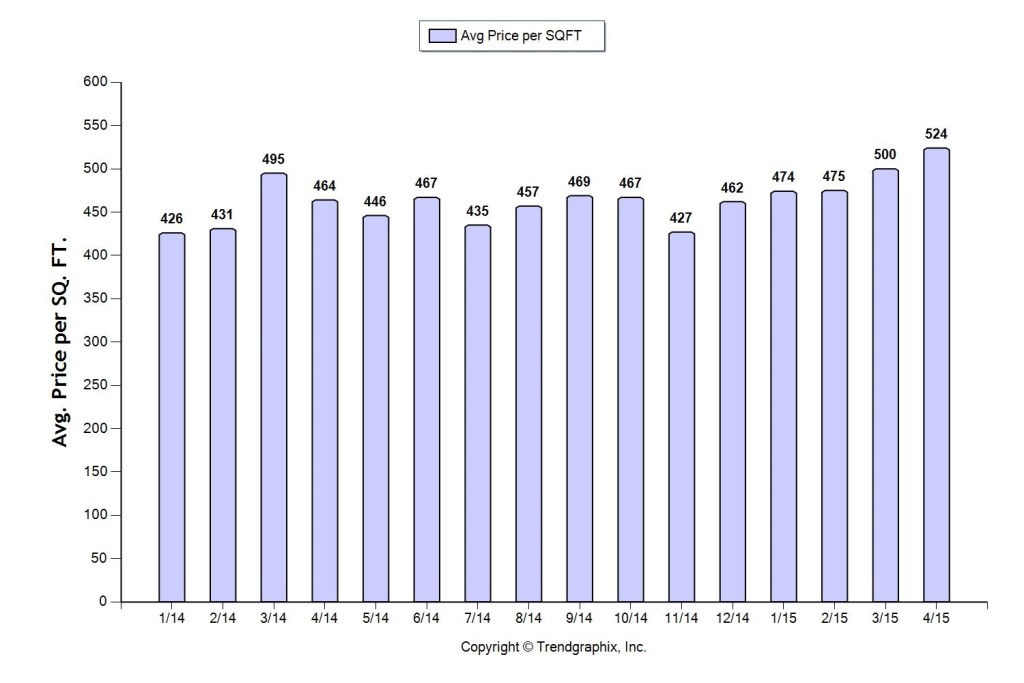

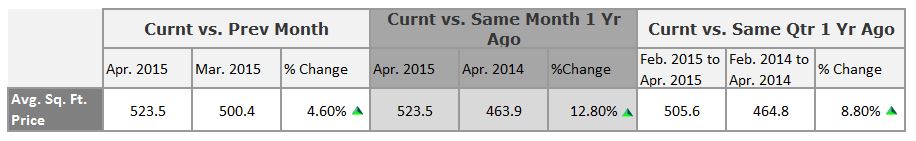

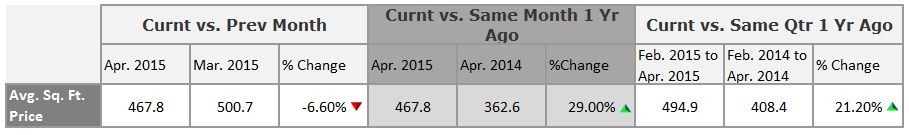

For this month’s market report we will keep with the price per square foot trends, comparing April 2015 month over month, year over year and the current quarter to the same quarter last year. In April, demand was steady for Playa Vista home sales which continues to outpace supply.

Playa Vista Home Sales under $1,000,000

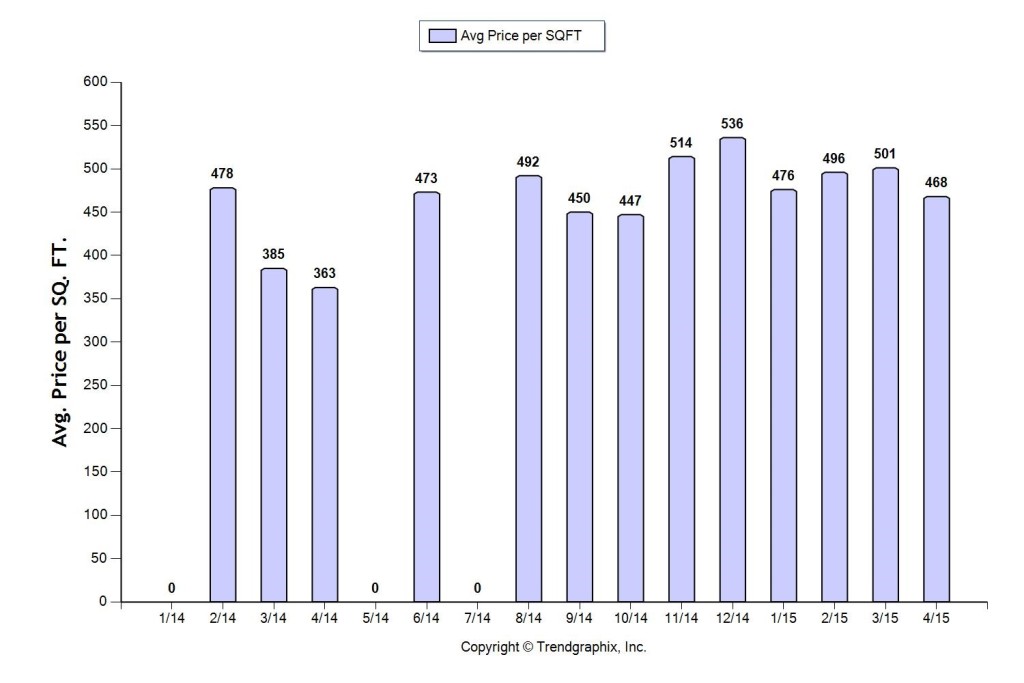

Playa Vista Home Sales over $1,000,000

There are increasingly more homes sold in Playa Vista over $1,000,000 but they are still too few to chart meaningfully.

All of the data is from the Playa Vista Phase I resale market. It does not include new construction in Phase II.

If you have questions about this report or the Playa Vista real estate market I can be reached at your convenience.

These analyses were made in good faith with data from sources deemed reliable, but they may contain errors and are subject to revision. Statistics are generalities and how they apply to any specific property is unknown without a tailored comparative market analysis. All numbers should be considered approximate. Please contact us with any questions or concerns.

This information is deemed reliable but not guaranteed. This is not intended to solicit listed property. If your property is currently listed for sale with a broker, please disregard.