by Tami Humphrey and Chad Aronson

What are the local and national market conditions pushing prices higher in Playa Vista?

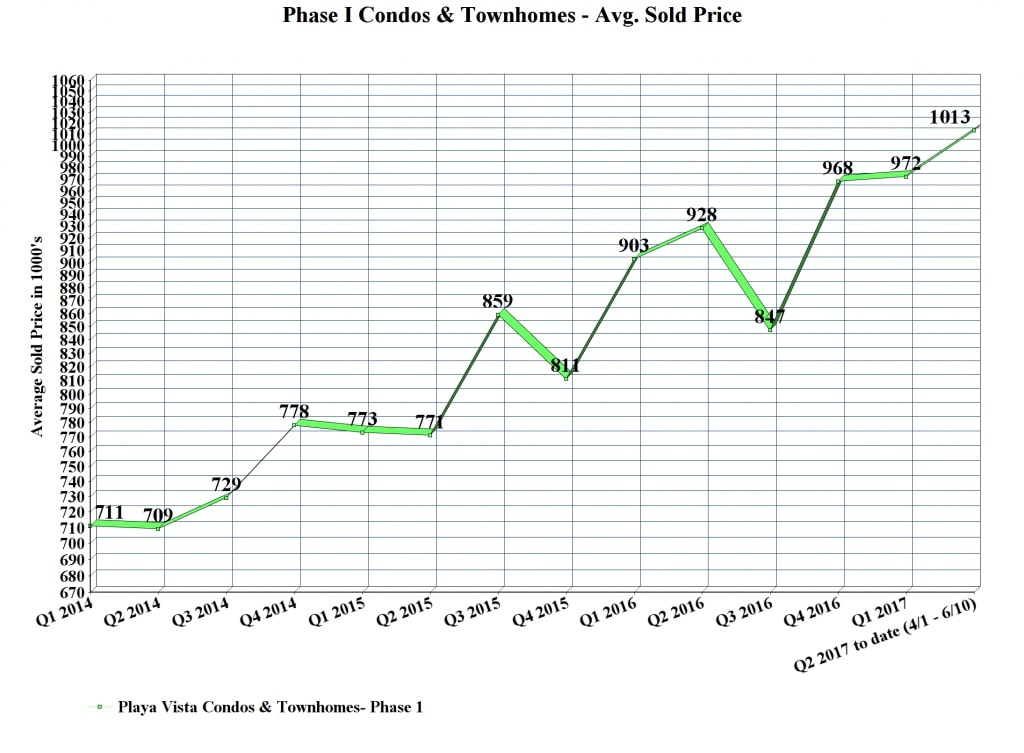

The average sold price for Playa Vista Phase I Condos and Townhomes has broken the $1,000,000 mark and there are no signs of slowing down. Low inventory, interest rates, and the local and national economy are all contributing to the rise.

Low Inventory

Across the nation, low inventory is a major reason for increasing prices. In a recent survey from the National Association of Realtors (NAR), about two-thirds of buyers said family concerns–the need for a larger home, a job relocation, or marriage or divorce–triggered their decision to move. In short, the decision wasn’t based on broad economic trends or how much equity they had in their sale properties. The NAR believes the number of home sales in the coming years will depend, in part, on the actions of parents with young children. Will they stay put to retain their low interest rate or seek that bigger house closer to schools?

With increased prices all over the Westside and South Bay of Los Angeles County, potential sellers are asking themselves, “Where do we go if we decide to sell?” In response, more homeowners are tapping into their equity with HELOC’s to remodel instead of moving to a new “updated” home.

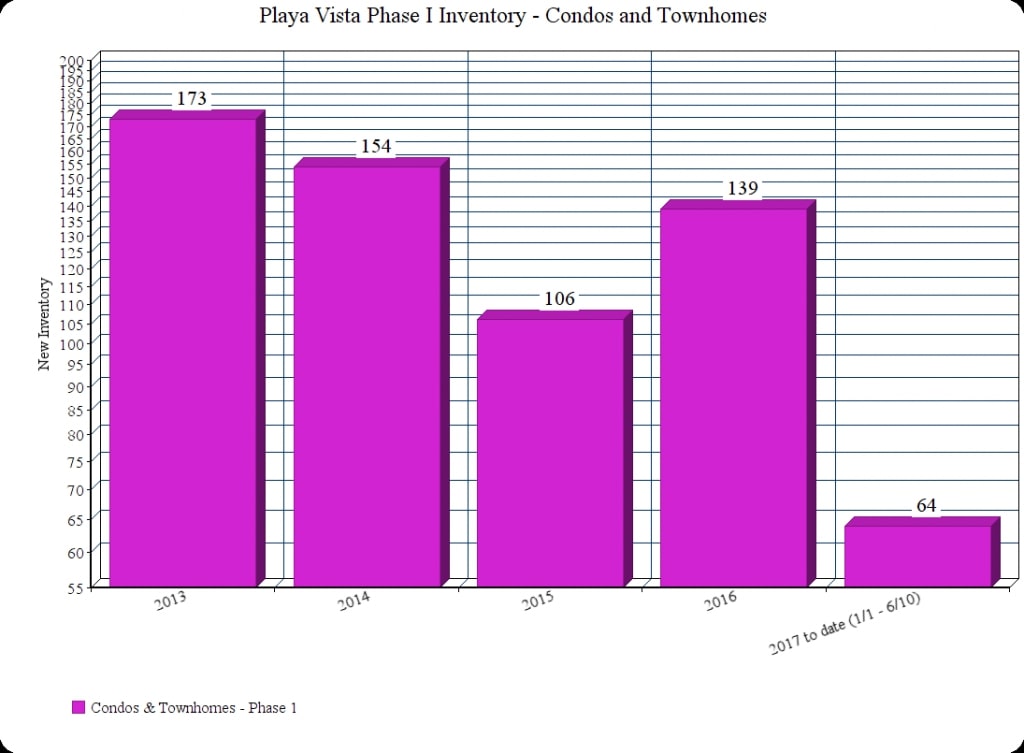

Looking at Playa Vista’s inventory trends for Phase I condos and townhomes, comparing 2013 to 2015 there were 38% fewer listings in 2015. Then inventory bounced back a bit last year to a total of 139 new listings for sale. Based on the early 2017 numbers we predict this year will have a very similar amount of new listings as 2016.

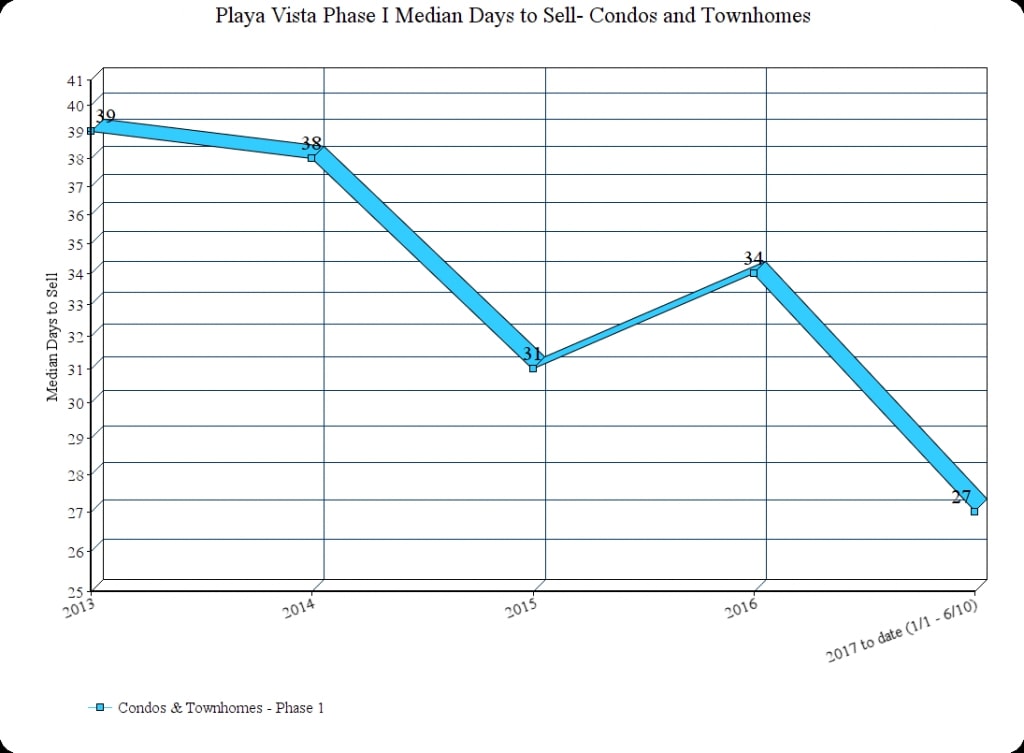

Demand has definitely increased this year. Homes are selling faster so far in 2017 compared to any of the last four years. The median days on market is currently 27 compared to 34 days last year and 31 days in 2015 when inventory was at its lowest point.

The number of leases in Playa Vista is also affecting the for sale inventory. Leased properties have gone up from 56 in 2014, to 86 in 2015 and then 92 last year. So far this year we are on pace for 86 Phase I condos and townhomes to be leased.

The big jump in leases from 2014 to 2015 may account for the super low new inventory for sale in 2015. 2014 and early 2015 is the time period when Camden, Skylar, Woodson, Trevion, and Asher were selling in Phase II. Our thought is many Phase I home owners who bought in Phase II decided to rent their Phase I home rather than sell.

While there are new investors buying and then leasing properties in Playa Vista, from what we see, the majority of the increase in leasing is from owners that have chosen to buy another home and convert their Playa Vista condo into an investment. It makes sense with the increase in rents and many owners purchasing their condos near the bottom of the market in 2012. While some will hold their investment for the long-term, others will attempt to time the market with the right time to sell.

Interest Rates

With an improving economy, higher interest rates are inevitable. Although rates have settled down recently, according to the NAR, they will likely surpass 4.5 percent by the end of 2017. The NAR also believe rates will go even higher in 2018. Multiple reports have the 30 year fixed rates crossing 5% sometime in 2018.

Rates are on the rise and buyers are hustling to find something sooner rather than later. In Playa Vista, over the past 2 months, we have seen multiple offers and the resulting increase in values for properties that were priced and marketed well. We expect to see a sharp increase in values in Q2 and Q3 of 2017.

As for potential sellers, if they don’t have to move, they may second guess leaving the lowest rates in history for their next home.

A Goldilocks Economy

According to economic experts, the nation is experiencing a Goldilocks economy. This economic phenomenon is when growth isn’t too hot, causing inflation, nor too cold, creating a recession. It has an ideal growth rate of between 2-3 percent, as measured by GDP growth. It also has moderately rising prices, as measured by the core inflation rate. The Federal Reserve has set this target inflation rate at two percent.

To maintain this ideal economic situation the Federal Reserve will adjust the Fed Funds Rate with the goal of keeping the economy going in the right direction and hitting its target inflation rate of two percent.

Looking at Playa Vista’s micro-economy, the amount of creative office space being built and the continued inflow of tech companies speaks for itself. Over the next couple years, close to 1,500,000 square feet of new office space geared towards tech, media, and advertising firms is expected to be filled with employees. This is on top of the already robust base of companies that call Playa Vista home.

Conclusion

As long time residents and Realtors in Playa Vista since 2006, we love this community and our neighbors. If you have any questions about this report or about the Playa Vista market please feel free to reach out to us, [email protected]. If you would like future reports delivered to your inbox sign-up here. You can also follow us on our Facebook page!

________________________

Playa Vista has four distinct market segments and we find it extremely helpful to look at the trends in each segment. With this article, we focused on how national and local factors are affecting Condos and Townhomes in Phase I of Playa Vista. In our next report we will concentrate on the other three market segments in Playa Vista: Phase I Detached Homes, Phase II Condos, and Phase II Detached Homes.

*The market segment Phase I condos and townhomes includes all attached homes in Playa Vista (excluding the few attached ICON’s) built from 2003 to 2011.

These analyses were made in good faith with data from sources deemed reliable, but they may contain errors and are subject to revision. Statistics are generalities and how they apply to any specific property is unknown without a tailored comparative market analysis. All numbers should be considered approximate. Please contact us with any questions or concerns.This information is deemed reliable but not guaranteed. This article is not intended to solicit listed property.