Delving Deep into Playa Vista Real Estate Trends: Navigating Market Dynamics & Interest Rates

The Playa Vista real estate landscape is undeniably complex. With changing interest rates and shifting sales patterns, understanding this market’s intricacies is paramount for potential investors and current homeowners. In this article, we’ll break down key trends and data to present a clear picture of the current and future state of Playa Vista real estate.

Understanding the Playa Vista Market

The Significance of the Trailing Twelve Months (TTM) Metric

The TTM metric is a valuable tool for understanding Playa Vista’s real estate scene. Given the relatively limited number of closed sales each month, this measure offers insights into market performance and its potential trajectory.

Playa Vista Market Trends – Trailing Twelve Months (TTM)

The Decline of Closed Sales

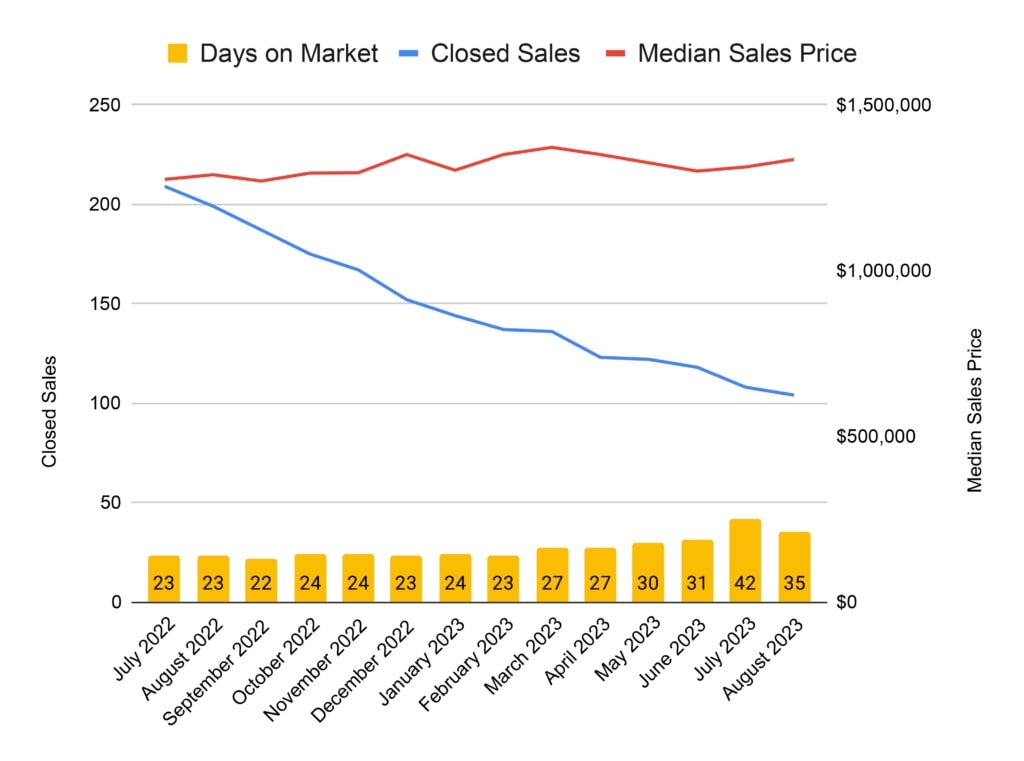

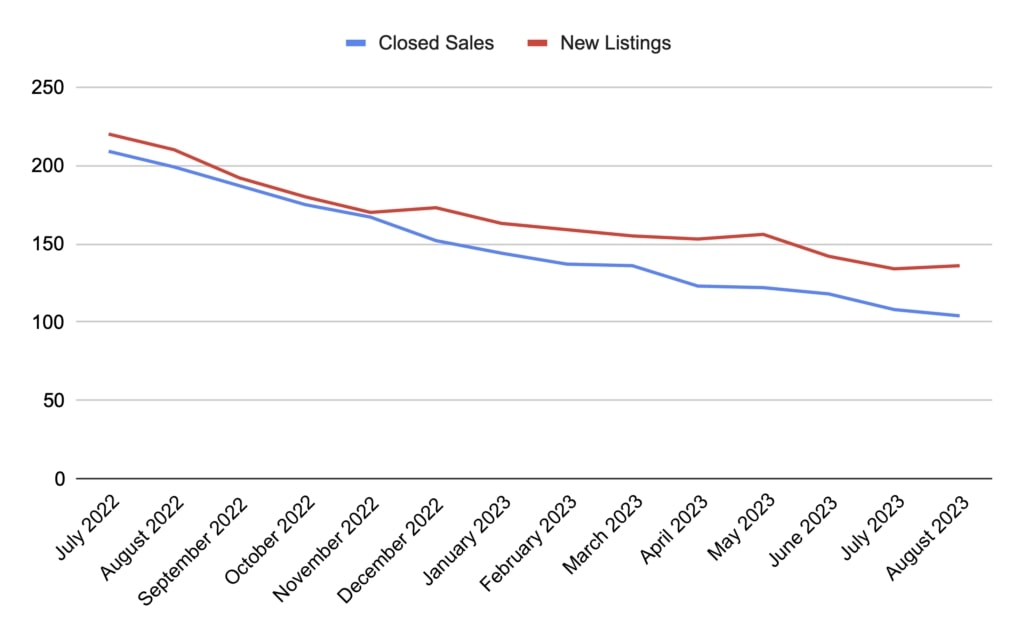

There’s been a notable decrease in home sales. A look at the numbers reveals a dip from 199 sales in August 2022 to just 104 in August 2023. With current projections, this number is expected to reach its nadir by year’s end, with a hopeful rebound in 2024. The interplay of interest rates, especially if they remain constant or dip in 2024, will be crucial in shaping this curve.

Historical Context

For perspective, between 2014 and 2019, a so-called “balanced” Playa Vista market would average around 140 sales annually. In August 2023, sales were 29.35% below this standard, largely attributed to high interest rates. Year-over-year figures further underscore this trend: a stark 48% drop from the TTM in August 2022, when lower interest rates played a part in driving sales.

Pricing Trends in Playa Vista

Despite the decline in closed sales, median sales prices remain fairly consistent. The dynamics at play? Homeowners are reticent to offload properties with favorable interest rates locked in, and high interest rates have cooled buyer interest.

In March, the median sales price stood at $1,371,500. By August 2023, there was a modest 2.7% decrease to $1,335,000. However, an annual comparison reveals a 3.5% price increase.

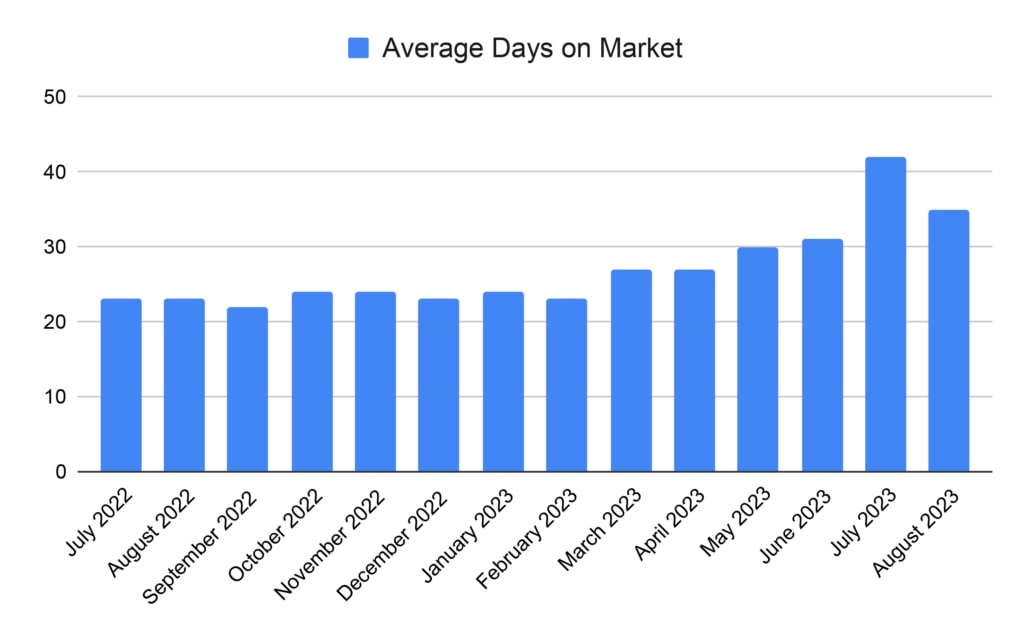

A Glimpse into the Days on Market

A property in Playa Vista, during the heart of the pandemic, would be on the market for an average of 23 days. Fast forward to July 2023, and this duration increased to 42 days, reflecting the ripple effects of the previous year’s rising interest rates. There’s a silver lining, though. As of August, properties were spending an average of 35 days on the market, indicating some momentum.

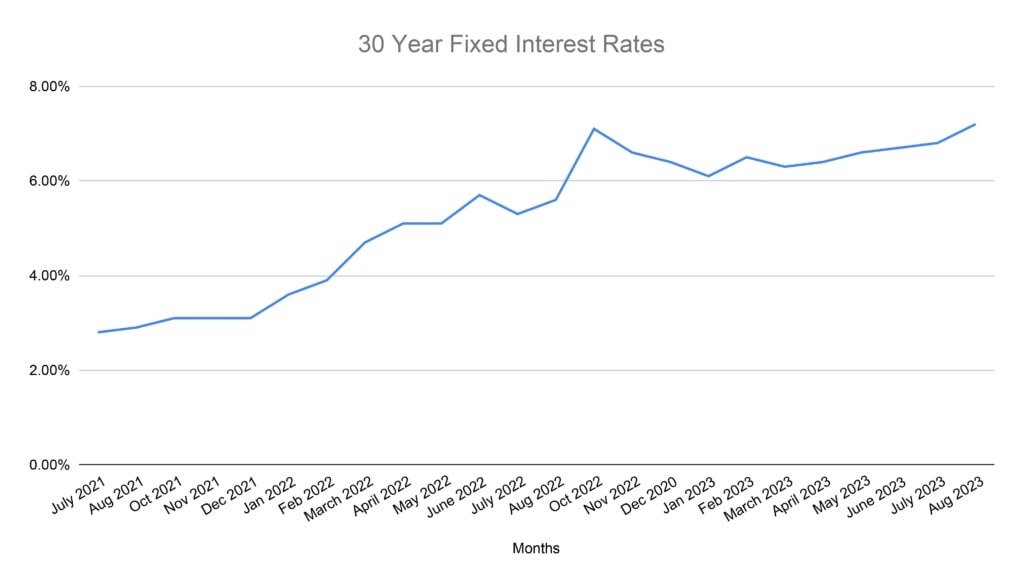

Inventory and Rising Interest Rates

The surge in interest rates has been a decisive factor in the Playa Vista real estate market. Many homeowners, comfortable with their sub-3% rates, are not eager to transition to mortgages hovering around 6%. This reluctance has undoubtedly impacted the number of homes available. Despite a decrease in listings, the market’s slower pace grants buyers more choices and a calmer decision-making process.

Playa Vista Closed Sales and New Listings – Trailing 12 Months

Future Interest Rates: What to Expect

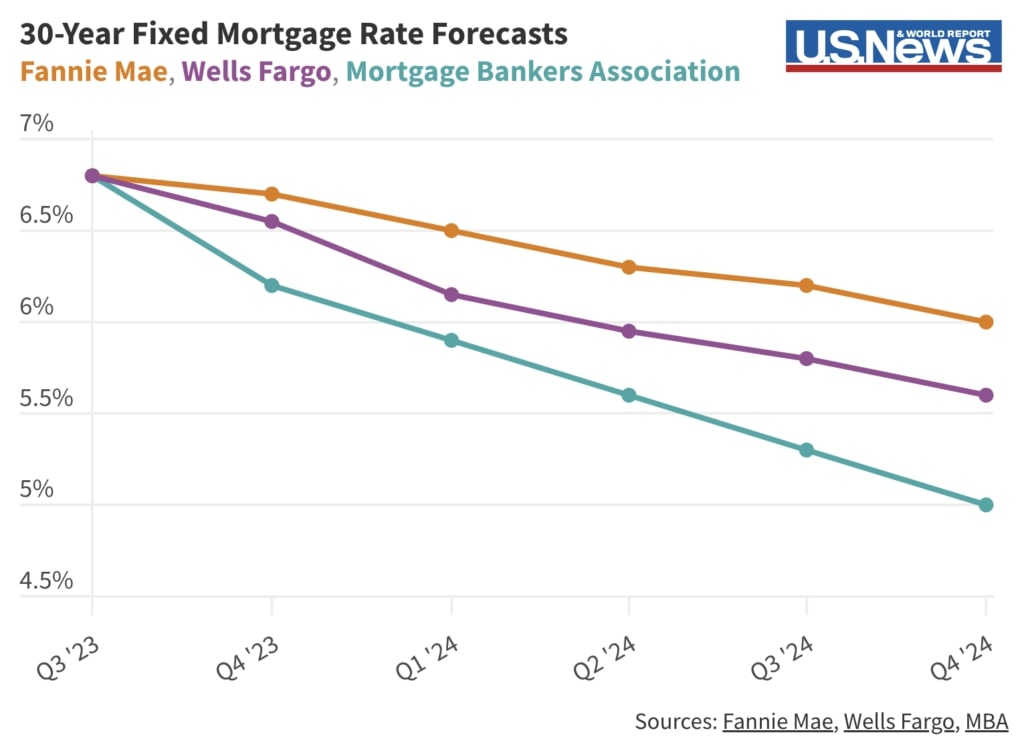

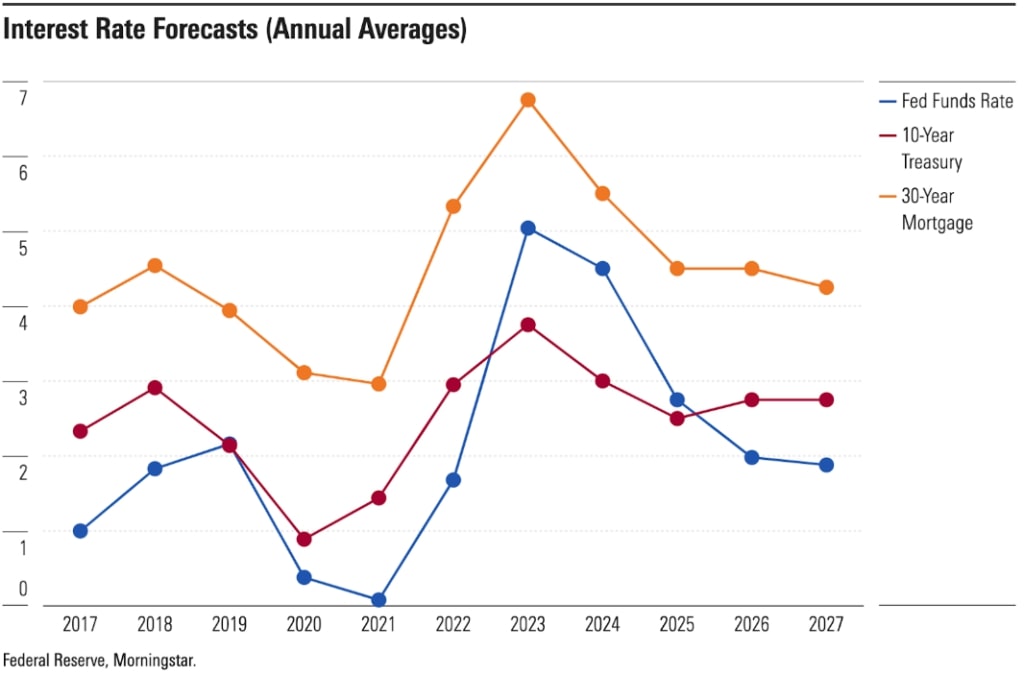

One of the burning questions is the future trajectory of interest rates. Major industry players, ranging from Wells Fargo to Fannie Mae and the Mortgage Bankers Association, predict interest rates to plateau or even decrease by 2024. Morning Star adopts a particularly rosy outlook, forecasting a dip to 4.5% by 2025.

Conclusion

The ebb and flow of the Playa Vista real estate market, driven by fluctuating interest rates and changing demand, requires close observation. For potential investors and homeowners, a deep understanding of these trends is essential for sound decision-making. As the mortgage rate landscape continues to evolve, staying updated on market movements will be pivotal for anyone looking to venture into or consolidate their position in Playa Vista’s real estate arena.